What is car insurance and how does it work?

by Admin

Posted on 21-08-2022 09:36 PM

This is a collaborative post but i thought you would like more information on car

insurance

so wanted to share it with you anyway. You’re legally obliged to get at least third-party insurance when driving in the uk. According to the government , driving without insurance is a serious offence and could cost you £600 and 6 penalty points.

What’s even worse, if the case goes to court you can be charged an unlimited fine and completely barred from driving. Now that we’ve covered how important car insurance is – let’s get into specifics, such as how car insurance works, why is it mandatory, car insurance groups and much more.

What’s even worse, if the case goes to court you can be charged an unlimited fine and completely barred from driving. Now that we’ve covered how important car insurance is – let’s get into specifics, such as how car insurance works, why is it mandatory, car insurance groups and much more.

Now that you’re an expert on what kind of car insurance you might need, it’s time to dig deeper into how to pick the right deductible. If you choose a high deductible, your insurance company looks at you as a lower risk and will reward you with a lower premium. If you choose a low deductible, your insurance company sees you as a higher risk and will—you guessed it—give you a higher premium. A $1,000 deductible usually means you’ll pay a lower premium. And since the first baby step is to save up a $1,000 starter emergency fund, you’ll have the savings on hand to cover your deductible.

According to our research, the current average cost of basic car insurance is $641 a year. This price is affected by factors including: the coverage limits you want. Where you live. Your driving and insurance claims histories. The best way to find the ideal price for you is to research different auto insurers for quotes. You'll be able to see side-by-side comparisons of coverages and costs from a variety of insurance companies, then pick the one that works best for your needs.

By marc deiter on may 3, 2019 in insurance basics coverage limits are the maximum amount a car insurance policy will pay after a covered accident. Once that limit is reached, you’re responsible for paying the rest of the cost out of your own pocket. That can be a hard pill to swallow if you are in a large accident where bills add up quickly. That's why it’s important to understand exactly how auto insurance coverage limits work and to review your policy occasionally to make sure you’re comfortable with the limits you have. Some prep up front can help save you from the headache and uncertainty after an accident.

How does car insurance work?

Car accidents can happen at any time to anyone, and while safety features can keep folks safe, insurance is there for what happens afterward.

This is why car insurance is not only essential to have, but also legally required in 48 states. Only new hampshire and virginia do not require drivers get insured. Not only does car insurance help folks get back on their feet after an accident, it can also help cover costs if you were the cause. Having car insurance takes away a lot of the hassle around accidents, injuries, and the whole legal process behind things.

This is why car insurance is not only essential to have, but also legally required in 48 states. Only new hampshire and virginia do not require drivers get insured. Not only does car insurance help folks get back on their feet after an accident, it can also help cover costs if you were the cause. Having car insurance takes away a lot of the hassle around accidents, injuries, and the whole legal process behind things.

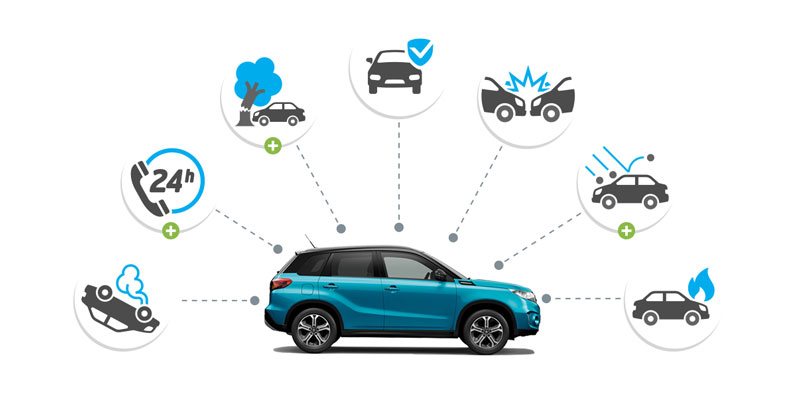

●published on : 26/08/2021 car insurance coverage is an important concept to understand when you buy car insurance. You drive to work or take your family out on chores and fun drives or enjoy time out with friends. As a responsible car owner, you keep your vehicle in good condition, obey the road rules while on the road and practise good driver etiquette. So, you wish driving your car to be a worry-free experience. Despite your precautions, your car could meet with unexpected contingencies on the road, such as major or minor accidents, breakdowns, tyre bursts, natural/man-made disasters and so on.

Last updated on september 9, 2021 an international driver’s license, also known as an international driver’s permit or idp, allows you to legally drive in a foreign county. But can you buy car insurance with an idp? if you’re a short-term visitor to the united states, then you might have an idp. This idp allows you to rent cars and drive the vehicle of a friend or relative. It could also allow you to buy car insurance. Today, we’re explaining everything you need to know about buying insurance with an international driver’s license, including how idp car insurance works.

The types of insurance listed above are the most basic types that cover injury and property damage to a third party, and they are the ones that most people are familiar with. However, there are many other ways to protect your car that you may find very important if you travel often or rely on your vehicle to get to work. Here are some of the most common types of insurance that are used to protect your vehicle itself:.