What is business contents insurance?

by Admin

Posted on 18-07-2022 10:08 PM

What is commercial property insurance?

If you run a business but don’t fully understand commercial property insurance and the impact of that coverage on your business’ contents & equipment, you need to read on as we break down the most important elements of commercial property coverage.

Commercial property insurance (sometimes referred to as commercial building insurance or business property insurance) is an important tool for protecting your business from a variety of potential harms. To operate your business successfully, you must be able to minimize disruption to the commercial buildings you work in, the equipment and technology you use day to day, and the inventory of products and materials you store, ship, and sell. Property coverage is only becoming more important: major natural disasters are becoming both more common and more severe throughout the country, and these sorts of events come with a big price tag, resulting in more than $70 billion in losses annually.

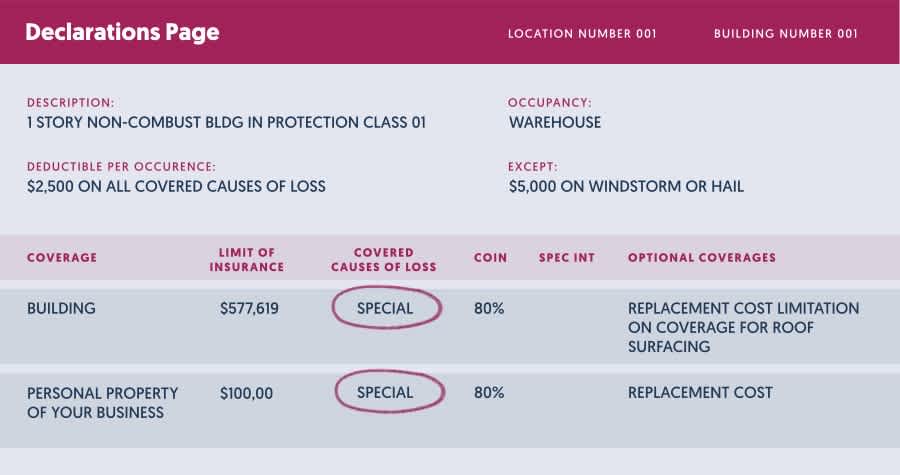

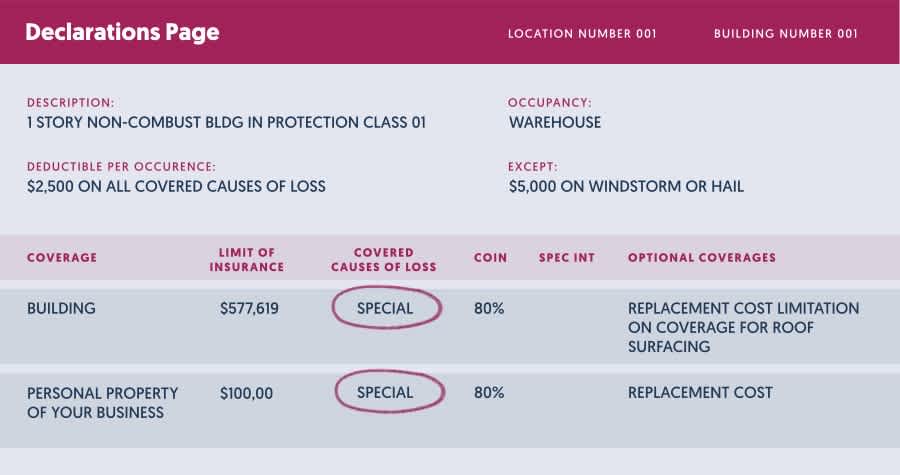

Most of the time commercial property insurance involves four broad coverage types. These four broad coverage types are usually coverage for buildings, contents, loss of income, and extra expense. Buildings and structures usually means more than just a physical building. In most policies they can also mean things that are permanently attached to the buildings or additions to it. Usually outdoor fixtures are also included in the definition of building property. Typically almost anything that is permanent and attached to the building or affixed to the premises can be considered building property. There is one category of items which are not permanent but can be lumped in to the building property coverage amount.

(a) “commercial property insurance” means insurance as defined in s. 624. 604 , but limited to coverage of commercial risks, excluding windstorm coverage, flood insurance, federal crop insurance, crop hail insurance, the pollution liability insurance association, and other federal governmental pools and associations. If separate rates and supporting experience data are not filed and justified for windstorm coverage, the insurer shall, using generally accepted actuarial and economic principles and techniques, identify and justify the premiums, losses, reserves, and associated data for the windstorm coverage excluded from commercial property insurance. (b) “commercial casualty insurance” means insurance as defined in s.

What is commercial property?

If you’re a small business owner with a brick-and-mortar shop, restaurant, studio or office that you own or work out of, bpp is essential coverage for all your inventory, equipment, upgrades and furniture. Here are some examples of how business personal property works with different businesses:

retail

sam owns a clothing store. The sprinklers fail at the commercial space he rents and destroy all of his new inventory. Bpp would help cover the replacement costs of his inventory and the repair costs of ruined furniture, computers and light fixtures. Restaurants

sophia owns a restaurant.

An electrical outage in the neighborhood shuts off her freezers and refrigerated storage, ruining all of her food inventory.

Commercial residential - (apartment buildings) - wind only a contract for a commercial enterprise, which only covers damages from the peril of wind. Commercial residential - (condo associations only) - wind only a contract for a commercial enterprise, which only covers damages from the peril of wind. Commercial residential - (homeowners association) - wind only a contract for a commercial enterprise, which only covers damages from the peril of wind. Commercial residential - allied lines (condo associations only) commercial: property insurance coverage sold to commercial ventures. Property (allied lines): coverage protecting the insured against loss or damage to real or personal property from a variety of perils, including, but not limited to, fire, lightening, business interruption, loss of rents, glass breakage, tornado, windstorm, hail, water damage, explosion, riot, civil commotion, rain, or damage from aircraft or vehicles.