How commercial general liability insurance protects your business

by Admin

Posted on 16-07-2022 07:38 PM

What Doesn't General Liability Insurance Cover?

The commercial general liability policy premium is based on a variety of factors, depending on the types of coverages included.

The size of the insured’s operations and the inherent risk of the products will impact the premium.

The size of the insured’s operations and the inherent risk of the products will impact the premium.

Businesses need to be prepared to protect themselves from accidents, injuries or property damage caused by day-to-day operations. No matter how careful your business is, mishaps can happen on the job or in the office. General liability insurance ensures you won’t be stuck with unexpected expenses when accidents happen. Emc is a seasoned commercial general liability insurance company. With more than 110 years of equipping businesses to be prepared for the unexpected, we know the type of insurance you need. Our independent agents will guide you through the business liability insurance process and help you select the right solutions for your business.

Shelter's general liability insurance can help you pay for bodily injury and property damage that you are legally liable to pay.

What would happen to your small business if a customer slipped on the floor and injured themselves, or an on-site mishap ruined your client’s property? chances are you’d be sued for damages. Without sufficient revenue or savings, you’d be on the hook for up to millions of dollars in compensation — unless your business is protected by general liability insurance. Commercial general liability insurance protects your small business from liability for covered claims of damage to a third party’s property and harm to a third party’s body or reputation. Though it’s one of the more basic forms of business insurance, general liability (gl) insurance is often required by state law, industry regulations, or the customers and clients you work with.

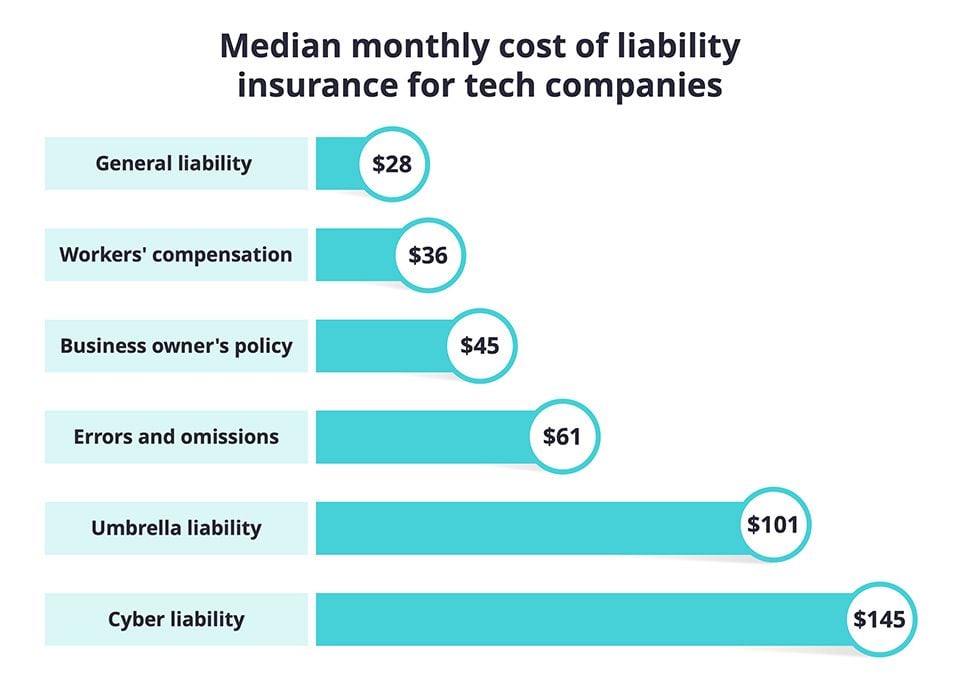

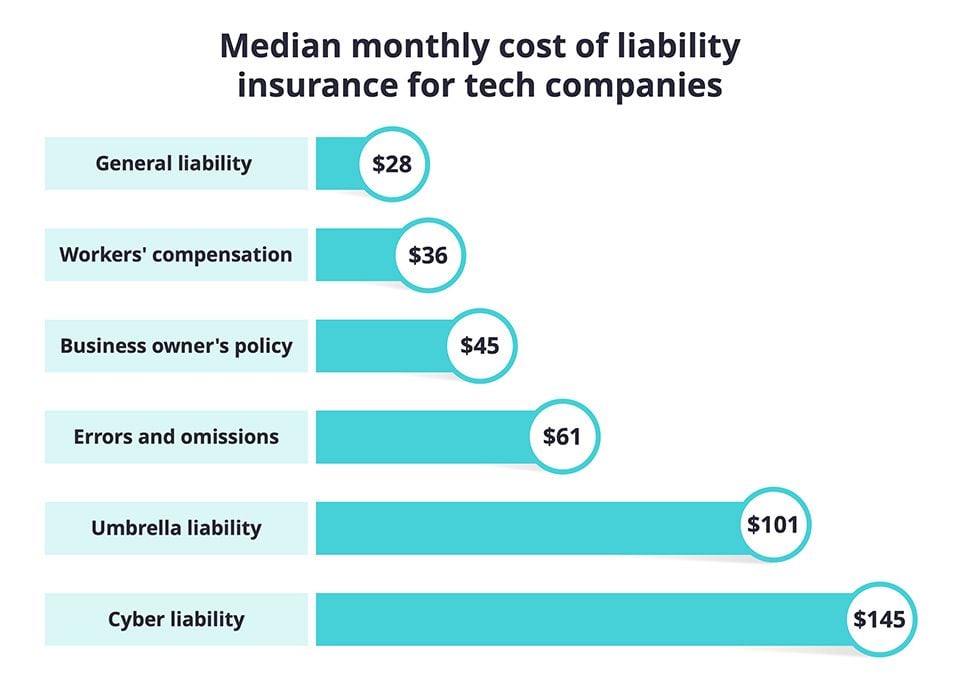

How Much Does General Liability Cost?

General liability insurance protects contractors and small-business owners against claims of bodily injury claims, medical costs, and property damage. It is often bundled with business liability insurance or property insurance but can also be purchased as a standalone policy. General liability insurance covers the following: bodily injury and property damage, lawsuits, medical, personal injury, contract liability, and more.

You don’t need to be a big business to face a lawsuit. And legal bills are no joke: a liability lawsuit taken to trial can cost $54,000 and a contract dispute can add up to $91,000 on average according to courtstatistics. Org. General liability insurance helps you recover from the most common business lawsuits. Even a simple accident can trigger a lawsuit, such as: a slip-and-fall accident. A customer trips over a power cable at your computer repair shop and breaks their wrist. They get hit with a hefty er bill and sue your shop to recover those medical expenses.